Computax Software Price List

We provide information, software, and services that deliver vital insights, intelligent tools, and the guidance of subject-matter experts. Wolters Kluwer Tax & Accounting US, is a leading provider of customer-focused tax, accounting and audit information, software and services for professionals in accounting firms and corporations.

The introduction of the (GST) will please most Indian businesses. It tremendously simplifies matters for any business that has to deal with VAT, CST, Octroi, Service Tax and even a few other taxes (pretty much all Indian businesses). The Goods and Services Tax is a new taxation system that will, under its umbrella, cover the whole lot of indirect taxes that were being levied by the government. GST will be imposed at the time of consumption, and the net tax will be calculated after accounting for all the taxes paid on input, just as in the case of VAT. The idea behind GST is to bring all businesses, freelancers and consultants under a single tax system, whether they sell goods or services.

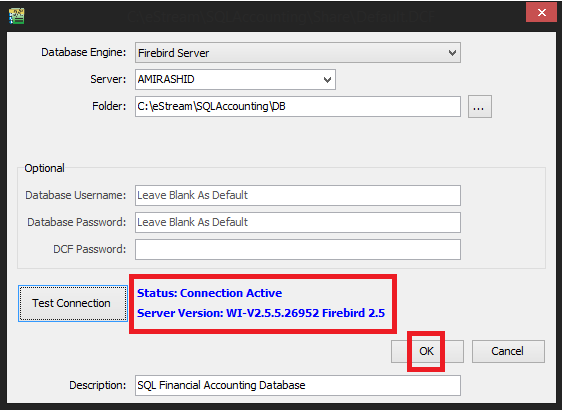

• Install the.reg file into the registry. Registry update • Remember to update the path in FirebirdDDEXProviderPackageLess32.reg or FirebirdDDEXProviderPackageLess64.reg, places where to update it are marked%Path%.

• Install the.reg file into the registry. Registry update • Remember to update the path in FirebirdDDEXProviderPackageLess32.reg or FirebirdDDEXProviderPackageLess64.reg, places where to update it are marked%Path%.

Currently, the government, which is expected to introduce it in April 2017, is expected to announce a rate of 18%. GST Eligibility Criteria As mentioned above, all those dealers who buy or sell goods, provide services or both, are eligible for GST. The gross annual income of the business should exceed Rs. 9 lakh (or reach the Rs.

4 lakh mark if the company is based in the North Eastern states, including Sikkim) for them to require GST registration. Currently, the threshold is the same for service tax registration. It is, therefore, likely that collection of tax will only be required on crossing Rs. 10 lakh in revenue (Rs. 5 lakh in any of the North Eastern states).

The range of firms covered under GST include dealers, bloggers, and writers, earnings from Google AdWords through PayPal, import-export businesses, all kinds of startups and companies, whether they are LLPs, proprietorships, partnerships or private limited companies. Any individual business (private limited company, LLP, proprietorship) with a supply turnover of over Rs.

25 lakh needs to register for GST in India. One can also apply voluntarily for GST registration to enjoy input tax credit (which would allow for adjustment of tax paid to suppliers).

Documents Required for GST Registration The list of documents required for registration of GST for various business are as follows: Proprietorship PAN Card of proprietor and address proof of the individual. LLP PAN Card of LLP LLP Agreeement Partners’ names and address proof Private Limited Company: Incorporation certificate PAN of Company Articles of Association Memorandum of Association Resolution signed by board members Identity and address proof of directors GST Registration Process The online registration of GST is simple and straightforward and is similar to what is done for service tax registration. Go to the GST registration portal and fill in the details/particulars asked in the application 2. Upload the original scanned copies of all documents specified. The application needs to be printed and sent to the GST department for confirmation. When you submit the application after filling in all the necessary details, an acknowledgment number will be generated, and the same will be communicated through SMS and email. After verification of the documents, the application will be reviewed and accepted.

A GSTIN will be generated on acceptance of the application and a temporary password and Login ID will be sent. GSTIN is a unique 15-digit ID. GSTIN will be one unique identification for your business.

Understand your GSTIN The 15-digit GSTIN or the unique identification number provided on GST registration carries some significant details on it. The first two digit of the GSTIN are the STATE CODE 2. The next ten digits (3 to 12) is your PAN NUMBER 3. The 13th digit is the ENTITY CODE and will be assigned to the type legal entity you are registering under.

Thus, if your application (with a particular kind of legal entity) is second in the state, the 13th digit would be ‘2’. It is again a state-based number. The 14th digit is left BLANK at present, to be filled at a later stage, by the deciding authorities. The 15th digit is a redundancy CHECK DIGIT used to provide Unique identification and for providing accuracy.